- #QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN FOR MAC#

- #QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN UPDATE#

- #QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN UPGRADE#

- #QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN FULL#

- #QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN SOFTWARE#

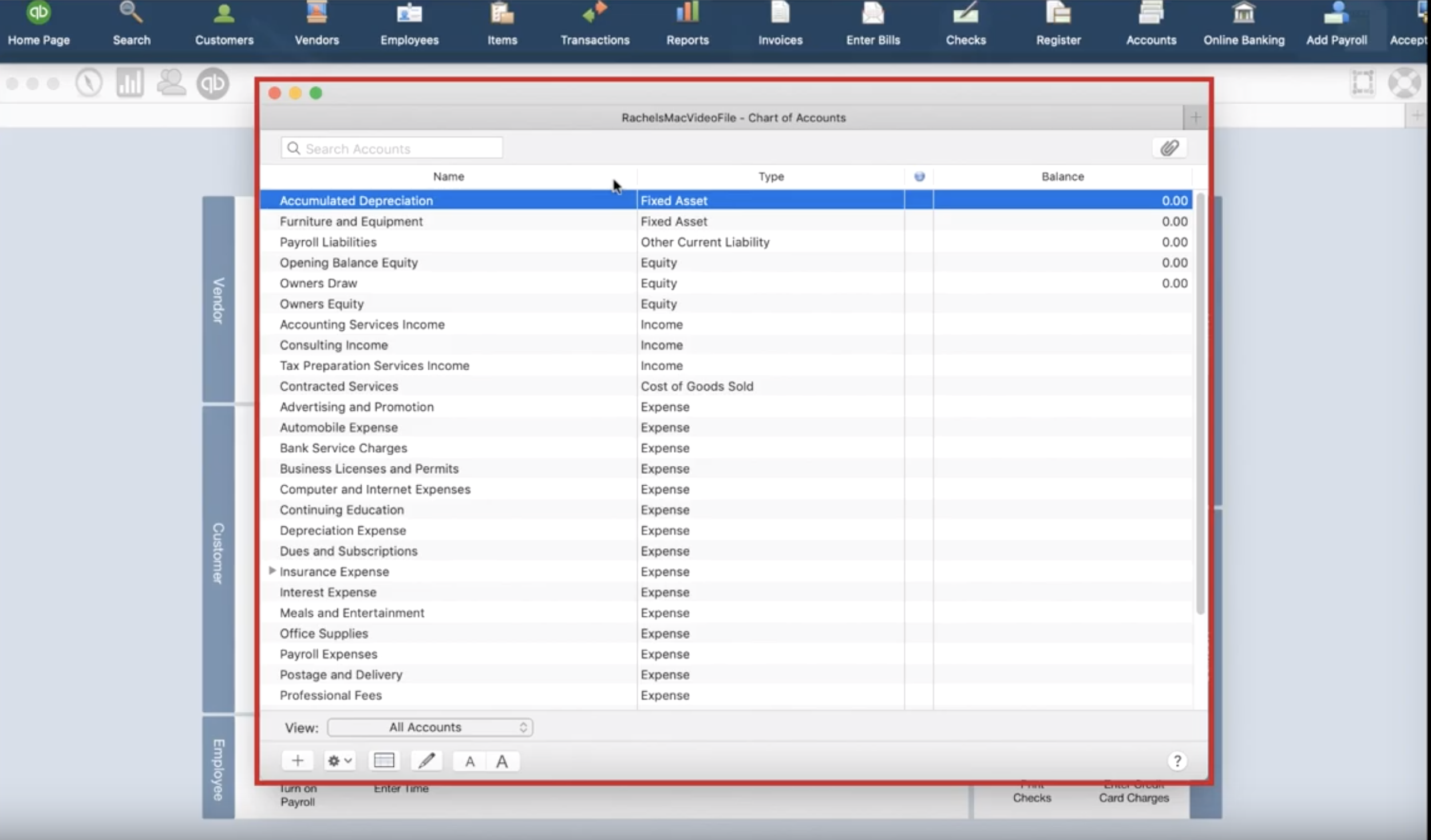

Many business’s financial accountants use QuickBooks daily to account for their sales, fees, inventory and product costs. QuickBooks is used to make online accounting easy by organizing everything, recording sales, tracking money spent and income all in one place.

#QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN FULL#

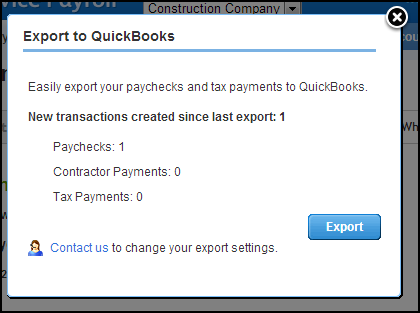

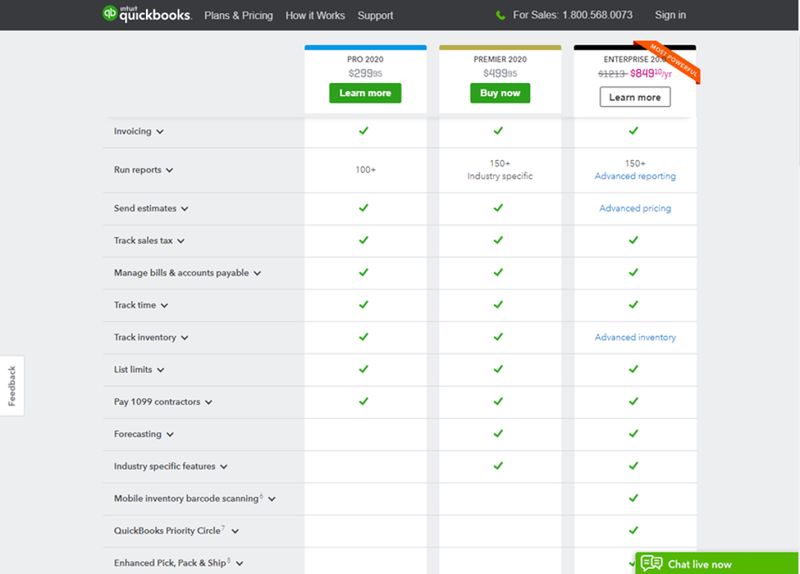

QuickBooks Desktop Basic Payroll costs $29 per month plus an additional $2 per employee, per month versus $45 per month (plus $2 per employee) for Enhanced and $109 per month (plus $2 per employee) for Assisted Full Service. How much does quickbooks enhanced payroll cost? With Intuit Online Payroll, you can automatically fill in tax forms, including federal and state forms. You can also set payroll reminders using Intuit Online Payroll. Intuit Online Payroll offers free direct deposit and makes automatic tax calculations. Intuit Online Payroll is a stand-alone product that you can use alone or with QuickBooks Online. What is intuit quickbooks payroll online? For example, when you write a check to pay the utility bill and enter utilities expense, QuickBooks makes the entry hitting both the checking account and the utility expense account. It automatically books the double-entry, meaning debit and credit. You need an accountant to confirm your records.

#QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN UPGRADE#

#QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN SOFTWARE#

› Qualitative Data Analysis Software Nvivo.› Quickbooks Tutorials For Beginners Free.For this reason, the business is able to run smoothly since all the workers are happy and are giving their best. Also, Freshbooks present the owner with a platform that ensures prompt payments. With Freshbooks there is no chance of overpaying or underpaying.

These compensation premiums are paid according to the worker’s payroll data. By synchronizing your workers’ compensation and payroll systems, workers’ compensation payment service makes payments to your workers automatically. Through this compensation payment service, businesses do not have to estimate anything or prepay anything. The reason why business owners should go for Freshbooks payroll is because of its compensation payment service that is exemplary and second to none. Instead of taking the tedious process of printing and mailing the forms, one can send them to the relevant agencies in Freshbooks.

#QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN UPDATE#

Works right inside Freshbooks- Payroll offers Businesses the chance to run Payroll inside Freshbooks integrated online service where books update automatically.Į-file and E-pay- You can set the filing method of your federal and state forms to E-file. This detailed accounting breakdown of Freshbooks helps them manage their operations best.Ībility to run Freshbooks payroll on the go- A business owner has the ability to pay employees without the limitation of location with their convenient mobile application. Freshbooks also offers a chance to business owners to come up with a detailed accounting breakdown of expenses that are as a result of payroll. This includes keeping a close eye on their wages, hours, bonuses, leaves, taxes, insurance, and other elements that would have a say on the final amount. The self-service can also be cancelled at any time by calling QuickBooks payroll support phone number.įreshBooks - The Better Alternative to QuickBooksįreshBooks payroll system provides business owners with a platform where they can calculate how much they should give to each employee. Self-service Payroll- QuickBooks self-service allows system allows employees to manage their own employee and payroll information.

For example, QuickBooks payroll support for website, QuickBooks Year-End center, QuickBooks payroll Tax Compliance among others. They can be printed and handed over to the employees.įree expert support- Intuit provides the following resources to support you in running your payroll. The main differences are 1) the way in which customers pay for access, and 2) the additional value included in the subscription offering.

#QUICKBOOKS MAC PAYROLL FOR ACCOUNTANTS LOGIN FOR MAC#

These rates and calculations are for supported state and federal tax tables and payroll tax forms.Ĭreate paychecks- A user can create paychecks with automatic tax calculations. QuickBooks Desktop Mac Plus is the same core product and has the same user interface QuickBooks Desktop for Mac customers are accustomed to. Payroll updates- QuickBooks payroll online provides the user with updates that have the most current and accurate rates and calculations. Intuit online payroll as a software on its own only extracts transactions to QuickBooks Desktop and QuickBooks online (without QuickBooks online payroll). Mac users use Intuit online payroll as their payroll add on. QuickBooks payroll service is not compatible with QuickBooks Mac. Depending on the features that a business owner prefers, they can choose from Basic, Enhanced or assisted payroll. A QuickBooks payroll service is a subscription that you activate to enable the payroll features in your QuickBooks Desktop Software.

0 kommentar(er)

0 kommentar(er)